Is Bitcoin the future of finance?

Edited by: Sara Fahmy

Photo Taken By: Omar Awad

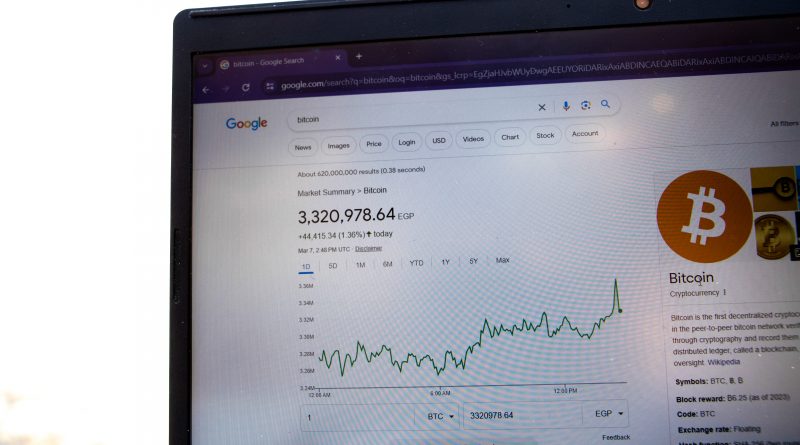

On February 12, 2024, Bitcoin (BTC) surged past $50,000 due to the growing acceptance of Bitcoin, as well as supply dynamics, inflation, and institutional adoption, marking a 16.3% increase this year and the highest since December 2021.

The increase in Bitcoin value was a surprise to many, and has piqued many investors’ interest; but with great return comes great risk.

Bitcoin is a digital currency, or cryptocurrency, that operates on a decentralized network of computers.

“Unlike traditional currencies, it doesn’t have a central authority like a government or bank controlling it,” explains Aya Selim, an adjunct faculty member teaching finance at AUC, a former money market dealer at QNB AlAhli, and a financial advisor.

Selim explained that the advantages of Bitcoin are decentralization, security, and accessibility. Selim added that it has, however, its shortcomings, namely volatility, regulatory uncertainty, and technological barriers. This makes cryptocurrency a double-edged sword that has exciting potential but not without challenges.

Assistant Professor of Integrated Marketing Communication Hesham Dinana shared his insights on the future of Bitcoin and whether it has the potential to replace fiat currencies or will coexist alongside it.

“I think they will co-exist for quite some time because of the fact that not everyone yet has the capacity or the technology to be able to mine this globally in our countries because of some regulations,” said Dinana.

He added that Bitcoin can be an investment option to some since people will see it as an additional asset, but it will only partially replace other currencies.

“I think at this point in time, it might not be recommended for smaller investors that have limited money because the risk can be too high because of the regulations issue,” said Dinana.